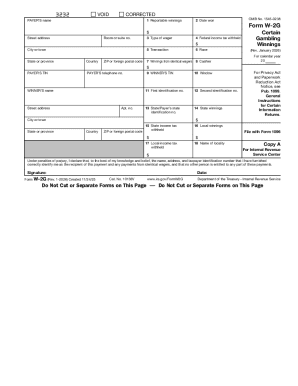

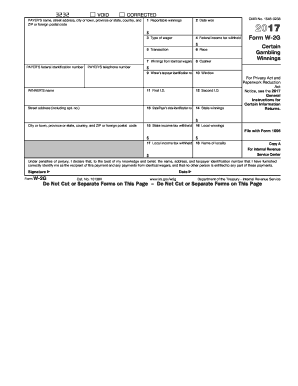

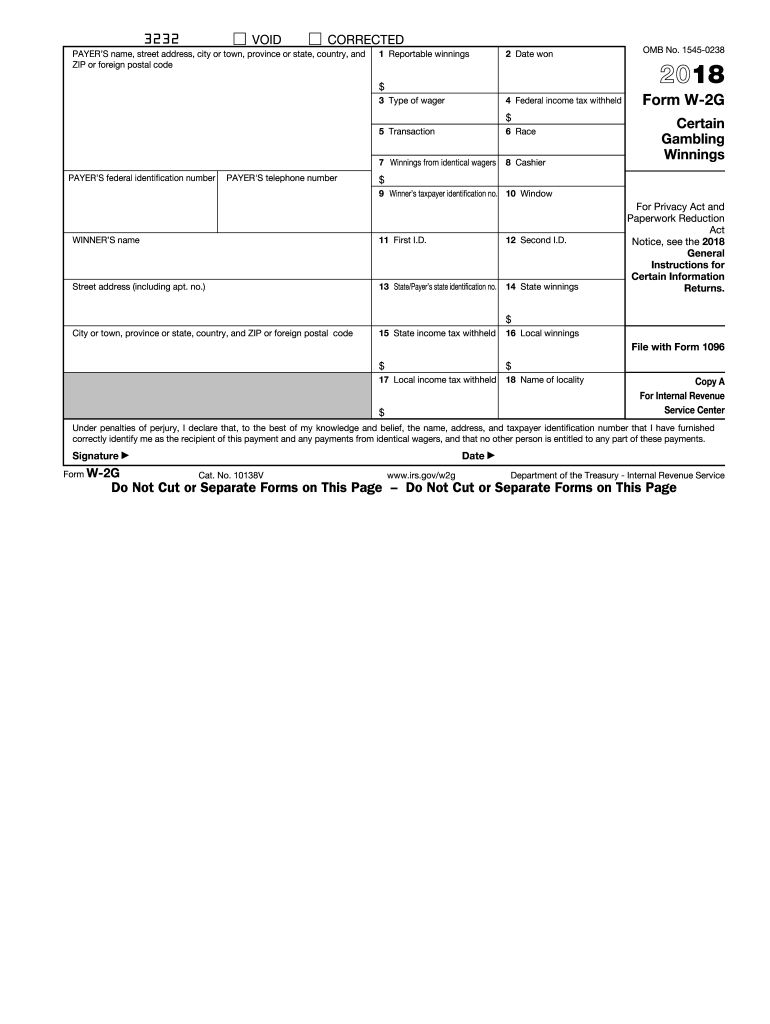

IRS W-2G 2018 free printable template

Instructions and Help about IRS W-2G

How to edit IRS W-2G

How to fill out IRS W-2G

About IRS W-2G 2018 previous version

What is IRS W-2G?

When am I exempt from filling out this form?

Due date

What payments and purchases are reported?

What are the penalties for not issuing the form?

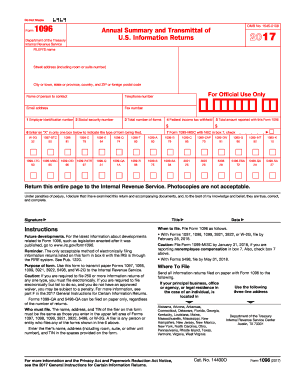

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS W-2G

What should I do if I discover an error after submitting my tax forms for gambling?

If you find an error on your tax forms for gambling after submission, you should file an amended return. This ensures that the correction is officially recorded. Typically, the IRS accepts Form 1040-X for amendments, and it’s advisable to include a brief explanation of the changes made.

How can I check the status of my filed tax forms for gambling?

To check the status of your filed tax forms for gambling, visit the IRS's 'Where's My Refund?' tool. You will need to provide specific details such as your Social Security number, filing status, and the exact amount of your refund. This helps determine if your forms have been processed and if any actions are required.

What should I know about the privacy of my information when filing tax forms for gambling?

When filing tax forms for gambling, ensure that your personal information is secure. The IRS is required to protect your data and maintain confidentiality. However, it’s essential to use secure networks and trusted software for online filing to safeguard against potential breaches.

What issues might cause my e-filed tax forms for gambling to be rejected?

Common reasons for e-filing rejection of tax forms for gambling include mismatched information with IRS records, missing signatures, or errors in the numbers reported. Always double-check the data entered and follow the software's guidance to minimize these issues before submission.

How should I handle a notice from the IRS regarding my tax forms for gambling?

If you receive a notice from the IRS concerning your tax forms for gambling, promptly read the communication to understand the issue. Respond within the specified timeframe, providing any required documentation or explanations. Keeping records of all correspondence is crucial for resolving any disputes efficiently.

See what our users say